Chief Financial Officer CFO Phone Number Database

The #1 site to find Chief Financial Officer CFO Phone Number Database. Emailproleads.com provides verified contact information for people in your target industry. It has never been easier to purchase an Contact list with good information that will allow you to make real connections. These databases will help you make more sales and target your audience. You can buy pre-made mailing lists or build your marketing strategy with our online list-builder tool. Find new business contacts online today!

Just $199.00 for the entire Lists

Customize your database with data segmentation

- Job Titles

- Job Function

- Company Size

- Revenue Size

- SIC Codes

- NAICS Codes

- Geographics

- Technology

- And more...

Free samples of Chief Financial Officer mobile number database

We provide free samples of our ready to use Chief Financial Officer contact Lists. Download the samples to verify the data before you make the purchase.

Human Verified Chief Financial Officer Mobile Number Lists

The data is subject to a seven-tier verification process, including artificial intelligence, manual quality control, and an opt-in process.

Best Chief Financial Officer contact number lists

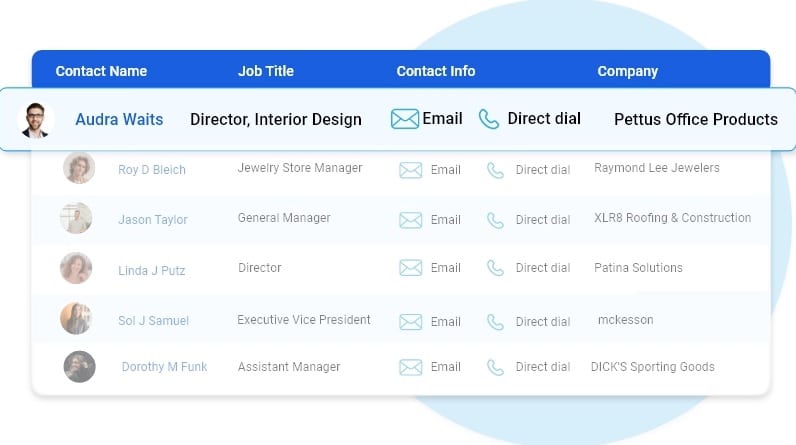

Highlights of our Chief Financial Officer Contact Lists

First Name

Last Name

Phone Number

Address

City

State

County

Zip

Age

Income

Home Owner

Married

Property

Networth

Household

Cradit Rating

Dwelling Type

Political

Donor

Ethnicity

Language Spoken

Email

Latitude

Longitude

Timezone

Presence of children

Gender

DOB

Birth Date Occupation

Presence Of Credit Card

Investment Stock Securities

Investments Real Estate

Investing Finance Grouping

Investments Foreign

Investment Estimated

Residential Properties Owned

Traveler

Pets

Cats

Dogs

Health

Institution Contributor

Donates by Mail

Veteranin Household

Heavy Business

Travelers

High Tech Leader

Smoker

Mail Order Buyer

Online Purchasing Indicator

Environmental Issues Charitable Donation

International Aid Charitable Donation

Home Swimming Pool

Look at what our customers want to share

FAQ

Our email list is divided into three categories: regions, industries and job functions. Regional email can help businesses target consumers or businesses in specific areas. Chief Financial Officer Email Lists broken down by industry help optimize your advertising efforts. If you’re marketing to a niche buyer, then our email lists filtered by job function can be incredibly helpful.

Ethically-sourced and robust database of over 1 Billion+ unique email addresses

Our B2B and B2C data list covers over 100+ countries including APAC and EMEA with most sought after industries including Automotive, Banking & Financial services, Manufacturing, Technology, Telecommunications.

In general, once we’ve received your request for data, it takes 24 hours to first compile your specific data and you’ll receive the data within 24 hours of your initial order.

Our data standards are extremely high. We pride ourselves on providing 97% accurate Chief Financial Officer telephone number database, and we’ll provide you with replacement data for all information that doesn’t meet your standards our expectations.

We pride ourselves on providing customers with high quality data. Our Chief Financial Officer Email Database and mailing lists are updated semi-annually conforming to all requirements set by the Direct Marketing Association and comply with CAN-SPAM.

Chief Financial Officer CFO phone number Database

Emailproleads provides Mobile Database to individuals or organizations for the sole purpose of promoting your business. In Digital Marketing. The mobile number database of Emailproleads helps to reach the highest level of business conversations.

Mobile number databases are a crucial marketing tool with many numbers from all over the globe. Since the arrival of smartphones, there has been an exponential rise in the number of buyers because technology has changed the way of marketing. Mobile number databases are essential for every retailer today in marketing and selling their goods and services. The world is now filled with mobiles that have internet connectivity across the globe.

Chief Financial Officer contact number lists

Now and again, we can see advertisements promoting the company. These ads result in the expansion of the company. It is possible to expand your marketing further using other services for Digital Marketing like Bulk SMS, Voice Calls, WhatsApp Marketing, etc.

Emailproleads checks every mobile number in the database using various strategies and techniques to ensure that buyers receive the most appropriate and relevant customer number and successfully meet their marketing goals and objectives.

This service assists you find your loyal customers keen to purchase your product. If you’d like to see your brand acknowledged by customers, using a database of mobile numbers is among the most effective ways to accomplish this.

What is the meaning of Phone Number Data?

A telephone number is a specific number that telecommunication firms assign to their customers, thus permitting them to communicate via an upgraded method of routing destination codes. Telecom companies give whole numbers within the limits of regional or national telephone numbering plans. With more than five billion users of mobile phones around the world, phone number information is now a gold mine for government and business operations.

What is the method of collecting the phone Number Data collected?

Having the number of current and potential customers and marketing professionals opens up a wealth of opportunities for lead generation and CRM. The presence of customer numbers is an excellent way to boost marketing campaigns as it allows marketers to interact with their target audience via rich multimedia and mobile messaging. Therefore, gathering phone number information is vital to any modern-day marketing strategy. The strategies consumers can use to collect data from phone numbers include:

* Adding contact forms on websites.

* Requests to be made for phone calls from customers.

* Use mobile keyword phrases for promotions to encourage prospective customers to contact you.

* Applying app updates prompts users to change their email details each time they sign in.

* Acquiring phone numbers that are already available information from third-party service companies with the information.

What are the main characteristics of the Phone Number Data?

One of the critical advantages of phone number data is that it is created to reveal the geographic location of mobile users because phone numbers contain particular strings specific to a region or country that show the user’s precise position. This is useful in targeted campaigns, mainly where marketers target a specific area that can target their marketing efforts.

To prevent duplicates and improve accessibility, the phone number information is typically stored in the E164 international format, which defines the essential characteristics of a recorded phone number. The specifications that are followed in this format are the number code for the country (CC) and an NDC, a country code (CC), a national destination code (NDC), and the subscriber number (SN).

What do you think of the phone Number Data used for?

The possibilities that can be made possible by the phone number information are endless. The availability of a phone number database means that companies worldwide can market their products directly to prospective customers without using third-party companies.

Because phone numbers are region – and country-specific and country-specific, data from phone numbers gives marketers a comprehensive view of the scope of marketing campaigns, which helps them decide on the best areas they should focus their time and resources on. Also, governments use the data from mobile numbers to study people’s mobility, geographic subdivisions, urban planning, help with development plans, and security concerns such as KYC.

How can an individual determine the validity of Phone Number Data?

In determining the quality of the phone number information, users should be aware of the fundamental quality aspects of analysis. These are:

Completeness. All info about phone numbers within the database must be correct.

Accuracy. This measure reflects how well the data identifies the individual described within the actual world.

Consistency. This indicates how well the data provider follows the rules to facilitate data retrieval.

Accessibility. The phone number database should be accessible where the data is organized to allow easy navigation and immediate commercial use.

Chief Financial Officer CFO Phone Number Database

Where can I purchase Phone Number Data?

The Data Providers and Vendors listed in Datarade provide Phone Number Data products and examples. Most popular products for Phone Number Data and data sets available on our platform include China B2B phone number – Chinese businesses by Octobot, IPQS Phone Number Validation and Reputation through IPQualityScore (IPQS), and B2B Contact Direct Dial/Cell Phone Number Direct Dial and mobile numbers for cold calling Real-time verified contact email and Phone Number by Lead for business.

How do I get my phone Number Data?

You can find phone number data from Emailproleads.

What are data types similar that are similar to Phone Number Data?

Telephone Number Data is comparable with Address Data; Email Address Data, MAID Hashed Email Data, Identification Linkage Data, and Household-Level Identity Data. These categories of data are typically employed to aid in Identity Resolution and Data Onboarding.

Which are your most popular uses for Phone Number Data?

The top uses that involve Phone Number Data are Identity Resolution, Data Onboarding, and Direct Marketing.

Let’s say you’re running a business selling strategy that demands you to connect with the maximum number of people you can. If your job is laid off for you, it can often be challenging to determine what to do. First, you should create your list of prospective customers and then save your call data in an electronic database.

Chief Financial Officer Telephone Number Lists

Though you might believe that working with lists of telephone numbers and storing them in databases is all you need to launch a cold calling campaign, it’s not the case. Since a telephone number database could contain thousands or millions of leads, along with important data points about each potential customer, It is essential to adhere to the best practices for a Database of telephone numbers. Methods to avoid becoming overwhelmed or losing important data.

To build a phone number database that delivers outcomes, you must start on the right starting point. It is possible to do this by purchasing lists of sales leads from a reliable, dependable company like ours. It’s equally important to have the right tools to allow your team to contact the most people possible.

In addition to high-quality telephone marketing lists, we provide advice on the best techniques for targeting databases and dialer software that can make lead generation more efficient and less expensive over time. Our customer service representatives are ready to assist you.

Chief Financial Officer Telephone Number Database Best Practices

After you’ve established the basis for success by acquiring high-quality lead lists and implementing dialers that can boost how many calls your team receives by up to 400 percent, you’re ready to become familiar with best practices for your industry. By adhering to a list of phones and best database practices, you’ll dramatically improve the odds that your team will succeed in the short and long term.

Chief Financial Officer cell phone number list

Here are the best techniques for telemarketing databases that you should consider a priority to observe.

Get Organized

A well-organized Chief Financial Officer mobile phone directory includes contacts organized according to phone country, postal, area, city, and province. By narrowing your calls to only one of the criteria, it is possible to incorporate new business information into your list, then sort and retarget top leads.

Chief Financial Officer mobile number list

Create a strategy to manage your phone lists. Naturally, your organizational plan must be based on the purpose of your cold-calling campaign. Your business’s goals will affect the traits your most promising prospects have. Make a profile of the most appealing candidate based on the plans for your marketing campaign. Make sure you make your leads list to ensure that the candidates who best meet your ideal profile of a prospect are first on your list of leads. List.

Chief Financial Officer cellular phone number list

Determine Who Has Access to and edit your database

Your phone number list doesn’t only represent an investment in money but also a resource that your team can use to increase sales. Although your phone number list is essential because you bought it, it’s also advantageous due to the possibility that it can improve your bottom line. In this regard, you should think carefully about who has access to and control your database.

It is generally recommended to restrict the number of users who have access to your database to only those who use it to communicate with potential customers to achieve your campaign’s goals. If an individual is not active with your marketing campaign, then there’s no reason for them to gain access to your telephone number database.

It’s also advisable to restrict access to the database you have created; it’s best to allow editing privileges to people who require them. This generally means that you only give editing rights to agents that will be conducting cold calls. It will be necessary to modify the database to make changes to records and notes that could aid in subsequent calls.

Chief Financial Officer phone number database

Create Your Database

Databases are knowledge centers that store information for sales personnel. They are vital to gain knowledge and share it with your sales staff. Even if it’s just to keep call notes, callback databases can help your sales team to achieve maximum value and benefit from lists of telemarketing calls.

As time passes, your phone number list will likely expand and include more contact numbers and information on your customers. When you get recommendations from your current prospects or purchase leads lists, or either, it’s essential to grow the size of your database to include as much data as you can to assist you in achieving your goals for the business in the near and far future and at every step in between.

4. Keep Your Database

Although you want your database to expand with time, you do not want it to contain obsolete or ineffective details. To keep your database from overloading with useless information, it’s essential to maintain it regularly, including removing old records and updating your prospective customers with their contact details.

One of the most effective ways to ensure your database is to ensure that it doesn’t contain numbers listed on the Do Not Call list. If you make a call to an address that is listed on a Do Not List, you could result in your business spending lots of money, perhaps even millions. With the free tools available online, think about scrubbing all your data against the Do Not Call registry at least twice yearly.

If you’ve learned the basics of a telephone list and best practices for database management, you can contact

Chief Financial Officer mobile number database

Emailproleads.com now to receive the top-quality leads lists you need within your database. phone number database free download

Today, download the mobile phone/cell numbers directory of all cities and states based on the network or operator. The database of mobile numbers is an excellent resource for advertising and bulk SMS, targeting specific regions of people, electoral campaigns, or other campaigns. Before you use these numbers, verify the ” Do Not Disturb” status in conjunction with TRAI. If it is activated, it is not permitted to use these numbers to promote your business.

Buy Chief Financial Officer Phone Number Database

It’s the quickest method of building an extensive list of phone numbers for your potential customers. Pay a fixed sum (per list, contact, country, or industry) and get every mobile number you paid for and have in your possession. You can then utilize them several times to reach out to customers to convince them to purchase their products or products. Doesn’t that sound great?

Chief Financial Officer phone number listing

Although it may seem like the fastest method of building a list of numbers, it’s not the case. There are a lot of risks associated with purchasing mobile marketing lists which won’t generate sales:

They’re not well-targeted. It’s impossible to be sure that every person on the bought phone lists will pay attention to the emails you’ve sent or your company worldwide.

It will help if you trust someone completely. When you purchase a mobile phone list, you’ll need to be able to trust your seller about how active the numbers are. It’s possible that the majority of the phone numbers you’re buying are not current or relevant.

Blog

Chief Financial Officer Phone Number List

Historically, the first public blockchain was Bitcoin, which was launched in 2009. Any computer, regardless of where it is located, can freely access this blockchain and be involved in the process of approving new blocks. New blockchain concepts have emerged since the Bitcoin launch. These new types of distributed ledger offer the advantages of blockchain technology but restrict access to the network and the rights of the different users.

There are currently three categories of blockchain. buy CFO database for marketing

Public blockchains: all participants are able to access the database, store a copy, and modify it by making available their computing power. Bitcoin, for example, is a public blockchain. CFO business phone number database free download

Consortium blockchains: these are open to the public but not all data is available to all participants. User rights differ and blocks are validated based on predefined rules. Consortium blockchains are therefore “partly decentralised”. R3 consortium, which brings together 70 of the world’s largest financial institutions to pilot the technology using a semi-private blockchain, is a good example of this category.

Private blockchains: these are where a central authority manages the rights to access or modify the database. The system can be easily incorporated within information systems and offers the added benefit of an encrypted audit trail. In private blockchains, the network has no need to encourage miners to use their computing power to run the validation algorithms. As an example, Crédit Mutuel Arkéa chose a private blockchain to share its customer data among the group’s different entities.

“Before setting up a private blockchain, you need to ask yourself whether a database is more suited to your needs.”

Six examples of blockchain concepts applicable in insurance

Blockchain technology has a wide variety of use cases in insurance, and the examples discussed below are just the tip of the iceberg. Our5 aim, however, is to shed light on the possible impacts on the insurance value chain.

Smart contracts

A smart contract is a contract between two or more parties that can be programmed electronically and is executed automatically via its underlying blockchain in response to certain events encoded within the contract.

The data needed to execute the contract may be located outside the blockchain. In this case, a new type of trusted third party known as an “oracle” pushes this information onto a certain position in the blockchain at a given time. The smart contract reads the data and acts accordingly (execution/non-execution). For example, in the case of cancellation insurance for a train journey, the oracle supplies information about the train’s arrival time (which CFO business email database free download

can be taken from the carrier’s website or from a GPS sensor fitted on the train).

The company Ledger proposes a hardware oracle solution that allows information to be pushed onto the blockchain in real time6. These hardware oracles use a series of sensors (connected devices, the IoT) to track events. There is huge potential here: in 2015, there were already over

5 billion connected devices; this should rise to 20 billion by 2020, for an estimated world population of under 8 billion.

CFO Cellular lists

There is a two-fold benefit of using smart contracts associated with the IoT:

Automation and autonomy of management processes based on data reported by connected devices and needed to fulfil the conditions for executing the smart contract.

Infinite and immutable data history based on a ledger that records all data (including data provided by connected devices). For both the insurance firm and its customers, this acts to guarantee transparency and simplicity, since the related data is present and secure on the blockchain without any action by either party.

Smart contracts therefore offer great potential, particularly in helping to accelerate the development of new models such as on-demand or just-in-time insurance.

On-demand insurance, which can be activated and deactivated at the customer’s request, is an increasingly popular product, particularly thanks to the boom in the sharing economy. New players are positioning themselves in this niche, including for example the InsurTech Cuvva, which allows drivers to arrange insurance in just a few minutes when borrowing a car7. Beyond this easy example, smart contracts can facilitate and help develop insurance cover in the sharing economy. With blockchain and the IoT, the insurance policy, claim and settlement can be automatically activated provided that the shared asset carries a sensor that can detect the start or end of the insured customer’s journey, or any other event triggering an insurance claim or payout. A company called Slock.it is even trying to build the future infrastructure of the sharing economy by enabling anyone to rent, sell or share anything – with no intermediary but with insurance8 that can be activated/ deactivated by means of a smart

DocuSign and Visa have already piloted a smart contract for the purchase, finance lease or operating lease of a connected vehicle, where the smart contract is fitted into the dashboard10. This partnership aims to facilitate and speed up the process of obtaining the associated paperwork, particularly for insurance, using a purely online solution. Chief Financial Officer Email List

Among those firms without a PoC or partnership, many have already begun analysing the technology or are at least tracking developments.

Peer-to-peer insurance

Peer-to-peer (P2P) insurance has been around for some time. And yet practices have evolved since Friendsurance13 introduced a new distribution model in 2010, with blockchain technology bringing new opportunities thanks to the principle of the decentralised autonomous organisation (DAO).

Smart contracts represent the first level of the decentralised application and they often involve human input, particularly when the contract is to be signed by a number of different parties. If the smart contract interacts with other contracts, it can also contribute to an “open network enterprise” (ONE). When ONEs are combined with the notion of an autonomous agent (programmes that make decisions without human input), a DAO, or an organisation that generates value without a traditional management structure, is created.

DAOs enable P2P insurance to be rolled out on a large scale, thanks to their capacity to manage complex rules among a significant number of stakeholders. Both incumbent insurers and new players could therefore position themselves more easily on this fledgling P2P insurance market. After all, P2P is ultimately nothing more than a new vision of risk pooling, the idea at the very heart of all insurance.Low

Index-based insurance

Index-based insurance is insurance linked to an underlying index such as rainfall, temperature, humidity or crop yield. This approach addresses the limits of traditional crop insurance in rural regions of developing countries, for example, by reducing management and settlement costs. In a region such as Africa, where insurance penetration is just 2% there is genuine scope for this type of insurance to gain in popularity15.

However, despite the multiple benefits of such insurance, putting in place an index-based product remains complex and costly. Considerable resources and technical expertise are essential in order to develop such products, particularly the infrastructure needed to gather data.

By basing such insurance on smart contracts, index-based products would be automated, simpler and cheaper. A smart contract between a farmer and an insurer may for example stipulate that payment is due after 30 number of days without rainfall. The contract is fed by reliable external data (e.g., rainfall statistics compiled by national weather services) supplied by oracles (see section 2.1), and payment is triggered automatically after 30 days’ drought with no need for an insurance claim from the insured party or for an expert on-site assessment. This type of mechanism could represent an alternative to traditional agricultural insurance.

Possible use in industry agreements

The IRSA Agreement in France – or agreement for the direct compensation of the insured and recourse between car insurance firms – seeks to facilitate the settlement of damages in the event of a traffic accident. Created in 1968 and signed by most insurance firms in France, the IRSA Agreement is key in defining liability for an insured event and in settling insurance claims.

CFO lists

The agreement applies to traffic accidents in France involving at least two landborne vehicles insured by member companies. The principle is simple:

“Irrespective of the type of traffic accident and the nature or amount of the damage, member companies undertake, prior to seeking recourse, to compensate their own customers to the extent of their compensation rights, as per the provisions of general legislation.” buy CFO database for marketing

After an expert has assessed the damage, the insurer determines the liability of its customer and directly compensates the customer for any damage and injury caused. Compensation is directly based on France’s traffic regulations, and the liability determined is often in line with the provisions of general legislation. The insurer then seeks recourse against the insurer(s) of the opposing party on the basis agreed between the insurance firms:

If the amount of damages is below €6,500 excluding VAT, recourse is based on a fixed amount of up to €1,354 excluding VAT if the insured is fully liable. The recourse effected is proportionate to the share of liability of the insured.

_buy CFO database for marketing

If the amount of damages is above the €6,500 threshold, recourse is based on the actual amount of damages.

The main purpose of the IRSA Agreement is to speed up the settlement process for insured parties based on a common scale, and to ensure that insurance firms settle claims from their customers.

This is a typical situation in which several players are organised around a consensus process based on automatic mechanisms. We could imagine it as a consortium-type blockchain in which the approval process would be controlled by a limited number of selective nodes. For example, participating insurers could agree and organise the blockchain in such a way that a given block must be approved by at least

10 members in order to be valid. In this arrangement, not only is there a limited, selective number of participants involved in the approval process, but the notion of majority rule no longer applies.

In such a context, by acting as an automated trusted third party, the blockchain could clearly help to lower overhead costs while at the same time accelerating management processes and making them more secure. However, for industry agreements, the cost of setting up such an arrangement could be an obstacle, since all participants need to be able to connect their IT processes to such a system.

Other similar industry agreements exist, explaining the recent interest shown by the French Insurance Federation (FFA) in blockchain technology.

Reinsurance

Over the past few years, most major insurance groups have set up internal reinsurance mechanisms, often in conjunction with the introduction of Solvency II. The use of internal reinsurance enables capital requirements to be reduced for individual entities since the risk is transferred to a captive reinsurer, which may be a separate entity, or a department within the holding company. The insurance group can therefore gain in capital efficiency as diversification is concentrated at the level of the captive. Chief Financial Officer Email List

Internal reinsurance mechanisms often entail swift and complex exchanges of information in accordance with regulatory or fiscal requirements. These information exchanges may involve third parties such as brokers or professional reinsurers which supply internal transfer pricing for insurance at arm’s length.

_CFO database for sale

Insofar as there is a natural internal consensus for this type of situation, it may be possible to organise information flows for the internal reinsurance via a private blockchain.

CFO Phone Numbers

By automating the execution of reinsurance treaties through smart contracts, the entities concerned (e.g., group subsidiaries) would no longer need to be involved in the “declarative” phases of insurance (contracts, claims reporting, verification, settlement trigger, etc.).

Since the mechanism would be rolled out on a relatively small, intra-group scale, IT system investments would be limited. buy CFO database for marketing

In intra-group reinsurance, the Blockchain Insurance Industry initiative, or B3i, launched in October 2016 by five of Europe’s leading insurers and reinsurers (Aegon, Allianz, Munich Re, Swiss Re and Zurich Re) aims to launch a retrocession proof-of-concept (PoC).

In February 2017, B3i was boosted by the addition of ten more international insurers and reinsurers operating in Asia, Europe and North America (Achmea, Ageas, Generali, Hannover Re, Liberty Mutual, RGA, Scor, Sompo, Tokio Marine and XL Catlin). The results of the PoC are expected to be available in the summer of 2017.

In June 2016, SCOR launched a PoC for the exchange of reinsurance accounts with a view to specifically assessing the feasibility of using blockchain technology. The PoC was launched under the aegis of the Ruschlikon initiative, a global community of some 50 insurers, reinsurers and brokers committed to implementing e-administration and driving an efficient and modern market. Assisted by the start-up ChainThat, in two months SCOR successfully piloted exchanges of technical reinsurance accounts between two brokers and SCOR using a private blockchain based on Ethereum. Chief Financial Officer Email List

This first PoC enabled SCOR to gain further blockchain expertise from both an IT and business standpoint (the project involved a multidisciplinary team of around ten people), and to confirm the technology’s potential for “disrupting” all interactions within the insurance ecosystem. Its decision to join the B3i industry initiative as from the end of 2016 was a natural follow-on from this project. The aim for SCOR is not so much to confirm the feasibility of blockchain from a technical point of view (since this has already been largely addressed by the Ruschlikon PoC) but to answer questions about security, confidentiality, performance and scalability, and ultimately to identify use cases going forward.

The B3i PoC is making swift progress with significant input from participants. Initial results are expected in the summer of 2017.

The speed with which the market is organising B3i-type initiatives is an excellent indicator that a threshold has been crossed and the potential impact of blockchain technology has been recognised. This could have a snowball effect on the market, driven by leading insurance and reinsurance firms. Each firm will nevertheless decide on its own approach, depending on its priorities. The same applies for work on integrating the technology within proprietary information systems, which will probably require two types of exchanges to be hosted simultaneously for a certain period of time.

_CFO database for sale

Insurers, reinsurers and brokers from the Ruschlikon community are strong advocates for the digitalisation of all exchanges between stakeholders, and the results obtained so far have been convincing. However, volumes are still too low. Use of the blockchain will be a considerable driving force, with significant productivity implications for all players in the ecosystem.

In addition to the tests being undertaken by market players, we are also counting on the task forces being set up within associations and regulatory bodies to help drive home the message and make blockchain an industry-leading technology in insurance, reinsurance and brokerage.

Asset management is a highly regulated industry and involves a significant degree of interaction between its various intermediaries. The distributed ledger technology could improve process efficiency in this industry as well as cooperation between the industry’s different stakeholders. Chief Financial Officer Email List

What was the example application?

After ten or so interview sessions, 12 applications CFO database for sale

CFO Phone Numbers database

were presented to the steering committee, culminating in a vote on which application to develop. The example application selected was called the Smart Transfer Agent (Smart TA).

The Smart TA marks the first step towards a new vision of the asset management value chain. It manages the liability side of operations, i.e., investors, security purchases and sales, and the unwinding of cash and securities transactions.

Fundchain was launched in the summer of 2016 by ten of Luxembourg’s leading financial institutions – Banque International du Luxembourg (BIL), BNP Paribas, CACEIS, European Fund Administration (EFA), HSBC, ING Luxembourg, Pictet, RBC Investor & Treasury Services, and Société Générale Bank & Trust

– with the participation of PwC Luxembourg, University of Luxembourg and the start-up Scorechain.

The primary aim of the initiative was to develop a proof-of-concept for the application of blockchain, distributed ledger technology and smart contracts in the area of asset management.

Fundchain was organised in different phases and coordinated by PwC Luxembourg. The scenario was as follows:

Interview-based analysis of current industry “pain points”, determination of success factors for the initiative and definition of an example application.

Blockchain training sessions for all participants in order to guarantee common understanding and take-up of this new technology.

Common and bilateral collaborative workshops in order to define the particulars of the example application.

Chief Financial Officer CFO Phone Number Database

A hackathon to finalise development of the example application and consider its impacts (regulatory, financial, integration) in the production environment.

The Smart TA runs on a private Ethereum blockchain and transactions are managed by smart contracts. Different stakeholders in the value chain can access the blockchain through a shared application which manages access rights and the type of information that each stakeholder may access. The stakeholders are the investor, the fund manager, the fund accountant and the regulator.

The stakeholders each have their own node on the blockchain and can access the shared ledger.

What are the findings of the initiative?

The main finding was that the proof-of-concept was a success. Transactions in fund units can be performed on a blockchain with a shared ledger in real time, with the unwinding of cash and securities transactions also performed in almost real time.

Today, Fundchain is in its second phase and has begun to define a new series of goals. Building on its successful proof-of-concept, Fundchain has now chosen to build a product that is viable in the production environment. The initiative is also looking for new international partners, particularly from the asset management industry. Chief Financial Officer Email List

Two major challenges remain:

Preparation of a detailed report about the initiative and its findings with a view to obtaining a memorandum of understanding from the regulator and supervisory authority to work within a simplified regulatory framework.

CFO email listing

Preparation of specific use cases. Since we are probably at the peak or even just past the peak of the initial blockchain euphoria, we believe that now is the right time to develop use cases with detailed business plans and detailed technical and regulatory impact assessments.

What are the benefits of blockchain? buy CFO targeted email list

The initial use of blockchains in the corporate environment has been primarily aimed at reducing costs. Here, we discuss five practical examples of what blockchain technology can offer, namely a reduction in KYC costs, lower risk of fraud and insured property theft, a decrease in the need for human input, better pricing for insurance products, and the development of new markets.

Reduction in KYC costs

In the insurance and banking industries and the public sector, the requirement to compile documentation on customers and stakeholders (“Know Your Customer”, or KYC) is a costly, time-consuming process which could well be transformed by distributed ledger technology.

A variety of documentation is in fact compiled for a given customer in each organisation, without any of this information being exchanged.

The existing data centralisation model makes organisations particularly vulnerable. The number of cyber-attacks is on the rise and with it, the theft of millions of customers’ personal data. Yahoo: 1 billion accounts hacked in 2013, 500 million in 2014; eBay: 145 million hacked in 2014; LinkedIn: 117 million in 2012; JPMorgan: the accounts of 76 million retail customers and 7 million institutional customers hacked in 201418.

On the blockchain, data is not stored on a central database and information is protected.

Blockchain technology would lead to substantial gains by pooling processes through a shared, encrypted database. Goldman Sachs considers that consistent, coordinated use of blockchain technology in banking could save the industry between US$ 3 billion and US$ 5 billion a year in KYC and anti-money laundering (AML) costs 19. Chief Financial Officer Email List

Thanks to InterchainZ, a project borne out of a joint initiative between PwC KYC Centre of Excellence and the company Z\Yen, a KYC database

prototype has been created using blockchain technology.

The idea is to store and encrypt customer data and verify20 all those consulting their documentation as well as any changes made (marriage, death, etc.). Customers are given an individual encryption key which they then choose whether or not to make available to financial institutions.

The institutions will then be able to access certain documents and data allowing them to identify the customer in a secure, reliable manner. Customers may then contract insurance or open an account in an instant.

Without going so far as pooling data between insurers, banks, brokers and so on, this technology will already help to significantly reduce costs (although the cost savings should be considered alongside the required investment outlay) for groups and their subsidiaries.

_buy CFO database online

This has been illustrated by the partnership between IBM and Crédit Mutuel Arkéa, which recently announced that they had completed their first blockchain project to improve the bank’s ability to verify customer identity.

CFO email leads

The result of this successful pilot is an operational prototype based on a private blockchain network that provides an overview of customer identity in accordance with KYC requirements for all group entities.

Banks and insurers have various systems that separately manage customer identity for the different services they provide. As a result of this successful pilot, Crédit Mutuel Arkéa group and IBM are working to bring together the different silos of customer data by creating a single cross-business KYC platform to inform all of the bank’s processes, helping to reduce unnecessary duplication of information and requests. Blockchain technology identifies and uses all valid existing data already stored in the bank’s multiple systems of record, such as those relating to loan applications, life insurance enrolments and bank account openings.

In this instance, blockchain technology helps reduce costs by decreasing the need for personnel focused on KYC tasks, shortens processing time and therefore improves the customer experience. Reputational risk, which is a major concern for insurers, is also significantly reduced. Blockchains therefore help to simplify administrative processes and deliver efficiency gains. Customers receive better service, human error is avoided, and costs are reduced (the costs associated with processing such data are eliminated). Chief Financial Officer Email List

Lower risk of fraud and theft of insured property

Blockchain technology will also help organisations to tackle fraud. As an example, Everledger, which emerged from the start-up accelerator programme implemented by insurer Allianz France, has developed a certification system for luxury products that uses a mix of private blockchain/public blockchain technology21. Everledger uses a blockchain to create a global registry for precious stones. Specifically, Everledger inputs

40 characteristics for every stone recorded (cut, colour, clarity, etc.). This represents 40 metadata components which are then used to create a unique series number. This number will be laser-engraved on the stone and added to the relevant blockchain22. Once the database contains sufficient data (over one million diamonds had already been recorded at end-2016), if sellers cannot provide encrypted proof that they own the rights to the precious stone, it will be very difficult to sell. Any stones that are not engraved with the serial number or on which the engraving is difficult to see will lose substantial value.

By creating a global, tamper-proof registry, Everledger is making an effective contribution to the fight against theft and fraud, which costs insurers an estimated US$ 50 billion every year.

An equivalent example can be found in the directors’ and officers’ liability insurance market, which insures business leaders for actual or alleged errors that may be committed during the exercise of their duties, such as publishing inaccurate financial statements, failing to comply with legal provisions, and failing to pay salaries, severance or taxes.

Making financial transactions – and even companies’ published financial statements – secure would help to increase transparency and therefore mitigate risks for a market with a total theoretical capacity of over €500 million.

CFO email Profile

Automation of tasks with zero added value

Thanks to blockchain technology, processes can be automated and rendered more secure by eliminating the need for certain instances of human input.

A practical example of this is natural catastrophe insurance, which can be arranged using smart contracts as has been successfully piloted by the Allianz group since June 2016. The group’s settlement system simply requires two items of information that are incorporated into the programme:

The event must have been declared a natural catastrophe. CFO customers database

The location of the insured event must correspond to the region recorded as having suffered a natural catastrophe.

The aim is to avoid a repeat of Storm Xynthia (February 2010), when most victims were no longer in possession of the documents needed to submit their claims and had to wait over a year to receive their insurance payout. This type of incident, as well as being costly and protracted, tarnishes insurers’ reputations and makes customers wary of the insurance system.

The Allianz group’s use of a system based on a smart contract for reinsurance (“natural catastrophe swap”) improves the way in which claims are dealt with while reducing human input (since the contract is automated). When an event occurs that meets predefined conditions, all eligible catastrophe insurance contracts are automatically executed thanks to a code. This code also directly activates insurance payouts without the need for the customer to supply the requisite paperwork. However, the principle prohibiting unjust enrichment of a claimant on occurrence of an insured event is still applied. CFO customers database

As is the case for KYC teams, third-party administration and claim costs can be significantly reduced.

Better pricing

Recent advances in pricing have shown how static and dynamic behavioural factors influence risk, with insurers increasingly trying to capture these behaviours. Behavioural information could be compiled by connected devices and exchanged on a blockchain, so that prices would be almost constantly adjusted and optimised based on real-world information reported by the blockchain in real time. This remains a very innovative area, which still needs significant analysis and research.

Irrespective of blockchain technology, the insurance industry will inevitably evolve in a world where voluntary data sharing and the ability to assess customers’ behaviour and risk profiles on an ongoing basis will result in dynamic pricing and in dynamic, flexible and personalised insurance products and risk management.

Although blockchain-based dynamic pricing is clearly not for the immediate future, the impact of the technology on prices could be felt much sooner.

Underwriting, pricing and claims management processes may for example become faster and more efficient by deploying rules within smart contracts, which, in itself, would affect the competitiveness of the solutions on offer.

CFO business database

Emergence of new markets

Blockchain technology will enable new lines of insurance to be developed or expanded, as well as emerging markets to be reached. Today, 40%23 of the world’s population possesses neither a bank account nor insurance, particularly in Africa, Asia and South America.

A wider variety of insurance products and services

Using blockchain technology, insurers will be able to more quickly develop personalised products and services and enhance their insurance offer.

One trend in travel insurance for example is to offer insurance payouts in real time in the event of a covered claim. This is the value proposition developed by Berkshire Hathaway Travel Protection for instance24. Such positioning means that the insurer must connect its systems to those of airline companies (to obtain information on flight delays or cancellations for example) and then identify in its customer database those customers affected by the flight in question. This would then proactively open a claim which would entitle the customer to a prompt payout.

With blockchain technology, this value proposition could be managed in a fully automated manner, thereby reducing costs. InsurETH, based on an Ethereum smart contract and the result of a hackathon launched in 2015, has positioned itself precisely on this type of market25.

In this case, blockchain technology enables the fast-paced development of new services linked to a given product range. By combining data from contracts, claims and customer documents in general, the blockchain will also speed up the development of personalised insurance. Chief Financial Officer Email List

Growth in emerging markets

email marketing database CFO

Blockchain technology will also enable companies to reach new geographical markets, especially in developing regions in Asia and Africa. Thanks to the low incremental costs associated with smart contracts, new insurance products should be able to be developed in these countries.

As mentioned earlier, insurance penetration in Africa remains low. At the same time, the mobile telephony market has enjoyed explosive growth over the past few years, with over 70% of sub-Saharan African individuals now owning a mobile phone26. This has led to the development of mobile-based payments via telecom operators, which are increasingly usurping the role of banks. The most striking example of this is Vodafone’s hugely successful M-Pesa, launched in Kenya in March

200727. This mobile phone-based payment system already has more than 20 million users and sees over US$ 19.7 million transferred through its network each day. CFO business database

The insurance sector could also capitalise on the boom in new technologies to develop across Africa. Blockchain technology can help to simplify underwriting and information gathering processes, since those with an account would not need to show ID or present their bank details. A smart contract could be set up for a blockchain linked to customers’ mobile data, triggering an automatic settlement process should an insured event occur.

In many African countries, a substantial portion of the population does not have an official address. This causes numerous administrative headaches, since the lack of property rights generates problems with inheritance, limits the use of lending and makes it hard to take out any home insurance. Thanks to blockchain technology, simple GPS coordinates written onto a server would serve as the basis for a tamper-proof land register that can be accessed by all users, thereby facilitating the arrangement of home insurance.

Several other applications for distributed ledger technology have already been identified.

Blockchain technology would make contract subscriptions easier, such as in corporate insurance, for which a formidable amount of documentation needs to be provided (type of collateral, presence of alarms, type of windows, etc.) and often requires the on-site presence of an expert appraiser. In the future, insurers could help municipalities and construction/housing development companies to create DAOs using blockchain technology to store construction data or references used for security purposes. Companies would find it easier to take out insurance in these markets where there is still relatively little coverage.

CFO customers database

Foreseeable risks

The distributed ledger represents a clear opportunity for players in the insurance industry. However, several issues relating to market trends and technological change need to be considered. First, we need to take into account, as of today, the new competitive landscape that will emerge from the use of blockchains, as well as the need to rethink governance structures. Second, we must not overlook the fact that the development and use of this technology will require changes to the applicable legal environment. Lastly, one of the most critical issues today is scalability. purchase CFO email lists

A new competitive landscape

Some InsurTechs have capitalised on opportunities created by blockchain technology, as illustrated in the various examples outlined above. CFO business database

A recent PwC study (Opportunities await: How InsurTech is reshaping insurance)28 shows that 90% of insurance companies are concerned about competition from InsurTechs. Stephen O’Hearn, PwC Global Insurance Leader, sums up the situation:

“There is a risk of missing an opportunity to deliver customers a similar experience to one they already receive from retail and

technology companies. InsurTech will be a game changer for those who choose to embrace it. Insurers have unrivalled access to consumer data and using cutting-edge technology to thoroughly analyse it could result in significant benefits for the company.”

To head off this competitive threat, incumbents are starting to set up partnerships. Chief Financial Officer Phone Numbers List