Chief Investment Officers CIO Email List

The #1 site to find Chief Investment Officers CIO Email Lists and accurate email lists. Emailproleads.com provides verified contact information for people in your target industry. It has never been easier to purchase an email list with good information that will allow you to make real connections. These databases will help you make more sales and target your audience. You can buy pre-made mailing lists or build your marketing strategy with our online list-builder tool. Find new business contacts online today!

Just $199.00 for the entire Lists

Customize your database with data segmentation

- Job Titles

- Job Function

- Company Size

- Revenue Size

- SIC Codes

- NAICS Codes

- Geographics

- Technology

- And more...

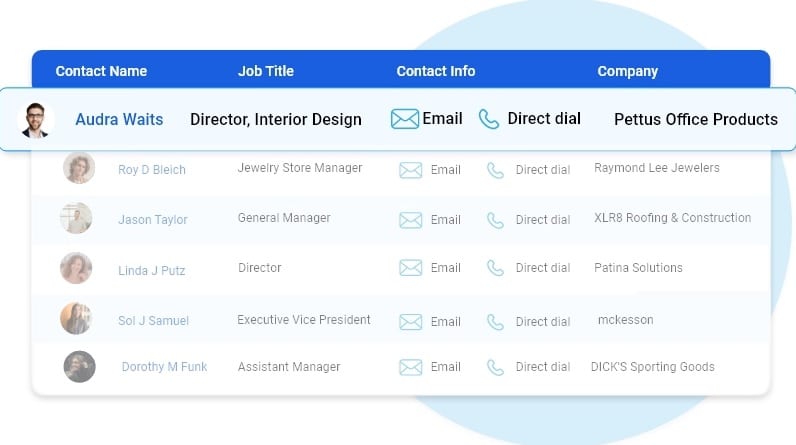

Free samples of Chief Investment Officers Email Lists

We provide free samples of our ready to use Chief Investment Officers Email Lists. Download the samples to verify the data before you make the purchase.

Human Verified Chief Investment Officers Email Lists

The data is subject to a seven-tier verification process, including artificial intelligence, manual quality control, and an opt-in process.

Best Chief Investment Officers Email Lists

Highlights of our Chief Investment Officers Email Lists

First Name

Last Name

Phone Number

Address

City

State

County

Zip

Age

Income

Home Owner

Married

Property

Networth

Household

Cradit Rating

Dwelling Type

Political

Donor

Ethnicity

Language Spoken

Email

Latitude

Longitude

Timezone

Presence of children

Gender

DOB

Birth Date Occupation

Presence Of Credit Card

Investment Stock Securities

Investments Real Estate

Investing Finance Grouping

Investments Foreign

Investment Estimated

Residential Properties Owned

Traveler

Pets

Cats

Dogs

Health

Institution Contributor

Donates by Mail

Veteranin Household

Heavy Business

Travelers

High Tech Leader

Smoker

Mail Order Buyer

Online Purchasing Indicator

Environmental Issues Charitable Donation

International Aid Charitable Donation

Home Swimming Pool

Look at what our customers want to share

FAQ

Our email list is divided into three categories: regions, industries and job functions. Regional email can help businesses target consumers or businesses in specific areas. Chief Investment Officers Email Lists broken down by industry help optimize your advertising efforts. If you’re marketing to a niche buyer, then our email lists filtered by job function can be incredibly helpful.

Ethically-sourced and robust database of over 1 Billion+ unique email addresses

Our B2B and B2C data list covers over 100+ countries including APAC and EMEA with most sought after industries including Automotive, Banking & Financial services, Manufacturing, Technology, Telecommunications.

In general, once we’ve received your request for data, it takes 24 hours to first compile your specific data and you’ll receive the data within 24 hours of your initial order.

Our data standards are extremely high. We pride ourselves on providing 97% accurate Chief Investment Officers Email Lists, and we’ll provide you with replacement data for all information that doesn’t meet your standards our expectations.

We pride ourselves on providing customers with high quality data. Our Chief Investment Officers Email Database and mailing lists are updated semi-annually conforming to all requirements set by the Direct Marketing Association and comply with CAN-SPAM.

Chief Investment Officers CIO Email Lists

Emailproleads.com is all about bringing people together. We have the information you need, whether you are looking for a physician, executive, or Chief Investment Officers Email Lists. So that your next direct marketing campaign can be successful, you can buy sales leads and possible contacts that fit your business. Our clients receive premium data such as email addresses, telephone numbers, postal addresses, and many other details. Our business is to provide high-quality, human-verified contact list downloads that you can access within minutes of purchasing. Our CRM-ready data product is available to clients. It contains all the information you need to email, call, or mail potential leads. You can purchase contact lists by industry, job, or department to help you target key decision-makers in your business.

If you’re planning to run targeted marketing campaigns to promote your products, solutions, or services to your Chief Investment Officers Email Database, you’re at the right spot. Emailproleads dependable, reliable, trustworthy, and precise Email List lets you connect with key decision-makers, C-level executives, and professionals from various other regions of the country. The list provides complete access to all marketing data that will allow you to reach the people you want to contact via email, phone, or direct mailing.

Accountant Phone number database

Our pre-verified, sign-up Email marketing list provides you with an additional advantage to your networking and marketing efforts. Our database was specifically designed to fit your needs to effectively connect with a particular prospective customer by sending them customized messages. We have a dedicated group of data specialists who help you to personalize the data according to your requirements for various market movements and boost conversion without trouble.

We gathered and classified the contact details of prominent industries and professionals like email numbers, phone numbers, mailing addresses, faxes, etc. We are utilizing the most advanced technology. We use trusted resources like B2B directories and Yellow Pages; Government records surveys to create an impressive high-quality Email database. Get the Email database today to turn every opportunity in the region into long-term clients.

Our precise Email Leads is sent in .csv and .xls format by email.

Chief Investment Officers Email Leads

Adestra recently conducted a survey to determine which marketing channel was the most effective return on investment (ROI). 68% of respondents rated email marketing as ‘excellent’ or ‘good.

Chief Investment Officers Email Leads can be cost-effective and accessible, which will bring in real revenue for businesses regardless of their budget. It is a great way for customers to stay informed about new offers and deals and a powerful way to keep prospects interested. The results are easy to track.

Segment your list and target it effectively:

Your customers may not be the same, so they should not receive the same messages. Segmentation can be used to provide context to your various customer types. This will ensure that your customers get a relevant and understandable message to their buying journey. This allows you to create personalized and tailored messages that address your customers’ needs, wants, and problems.

_CIO business database

Segmenting your prospects list by ‘who’ and what is the best way to do so. What they’ve done refers to what they have done on your website. One prospect might have downloaded a brochure, while another person may have signed up for a particular offer. A good email marketing service will let you segment your list and automate your campaigns so that they can be sent to different customer types at the time that suits you best.

Almost everyone has an email account today. There will be over 4.1 billion people using email in 2021. This number is expected to rise to 4.6 billion by 2025. This trend means that every business should have an email marketing list.

Chief Investment Officers Email List is a highly effective digital marketing strategy with a high return on investment (ROI). Because millennials prefer email communications for business purposes, this is why.

How can businesses use email marketing to reach more clients and drive sales? Learn more.

Chief Investment Officers Email marketing Database

Businesses can market products and services by email to new clients, retain customers and encourage repeat visits. Email Lists marketing can be a great tool for any business.

High Conversions

DMA reports that email marketing has a $42 average return per $1. Email marketing is a great marketing strategy to reach more people and drive sales if you launch a promotion or sale.

You can send a client a special offer or a discount. Chief Investment Officers Email Lists can help automate your emails. To encourage customer activity, set up an automated workflow to send welcome, birthday, and re-engagement emails. You can also use abandoned cart emails to sell your products and services more effectively.

Brand Awareness

Email marketing allows businesses to reach qualified leads directly.

Chief Investment Officers Email will keep your brand in mind by sending emails to potential customers. Email marketing has a higher impact than social media posts because it is highly targeted and personalized.

Contrary to other channels, a business can send a lot of emails to large numbers of recipients at much lower costs.

Increase customer loyalty

One email per week is all it takes to establish unbreakable relationships with customers.

An email can be used to build customer loyalty, from lead-nurturing to conversion to retention and onboarding. A personalized email with tailored content can help businesses build strong customer relationships.

Tips for capturing email addresses

A business must have an email list to use email marketing. You will need a strategy to capture these email addresses.

Chief Investment Officers Email Lists will get your email campaigns off the ground with a bang!

We understand that reaching the right audience is crucial. Our data and campaign management tools can help you reach your goals and targets.

Emailproleads are a long-standing way to market products and services outside the business’s database. It also informs existing customers about new offerings and discounts for repeat customers.

We offer real-time statistics and advice for every campaign. You can also tap into the knowledge of our in-house teams to get the best data profile.

Your Chief Investment Officers Email Lists marketing campaigns will feel effortless and still pack a punch. You can use various designs to highlight your products’ different benefits or help you write compelling sales copy.

Contact us today to order the email marketing database to support your marketing. All data lists we offer, B2C and B2B, are available to help you promote your online presence.

We already have the database for your future customers. You will be one step closer when you purchase email lists from us.

Talk to our friendly team about how we can help you decide who should be included in your future email list.

The #1 site to find business leads and accurate Chief Investment Officers Email Database Lists. Emailproleads.com provides verified contact information for people in your target industry. It has never been easier to purchase an email list with good information that will allow you to make real connections. These databases will help you make more sales and target your audience. You can buy pre-made mailing lists or build your marketing strategy with our online list-builder tool. Find new business contacts online today!

Blog

Chief Investment Officers Email List

ML can be described as an AI subset that defines the capacity for software programs to take lessons from data sets in order to improve itself without having to be explicitly programmed by humans (e.g. image recognition predictive of defaults by borrowers fraud, AML recognition) (Samuel 1959, 1959[77). The various kinds of ML are the following: learned by supervised methods (‘classical ML’, which consists of sophisticated regressions as well as categorizations of data used to improve prediction) in addition to unsupervised (processing input data to comprehend how data is distributed and create, for instance automatized customer segmentations) as well as deeper and reinforced learning (based in neural networks, and could be applied to non-structured data, such as voice or images) (US Treasury 2018[8[8]). buy CIO email database

The neural networks of deep learning are attempting to model the way that neurons interact inside the brain, using a variety of (‘deep’) layers of virtual interconnectedness (OECD 2019, 2019[4[4]). The models make use of multi-layer neural networks5 to understand and identify complex patterns in data in a manner that is influenced by the way the brain functions. Deep learning models are able to recognize and classify data input without the need to write specific rules (no requirement to define particular detectors) and also can detect new patterns that humans would have thought of or developed (Krizhevsky, Sutskever and Hinton 2017[10[10, 11]). They are thought to be more tolerant of noise and work at multiple layers of generality derived from sub-features.

_CIO quality email lists

ML models make use of huge quantities of other sources of data and data analytics, which are referred to as “big data’. The term”big data” was coined in beginning of the 2000s, when Big Data was used to refer to “the growth in the volume (and sometimes, the quality) of accessible and relevant data, mostly due to new and unimaginable advances in storage and data recording technology” (OECD 2019, [4]). The big data ecosystem includes data sources and software, analytics software as well as statistics, programming as well as data analysts who synthesize the data in order to eliminate the noise and generate meaningful outputs.

The attributes of big data are the ‘4Vs’ of Volume (scale of information) and speed (high-speed process and analysis data streams) as well as diversity (heterogeneous data) as well as veracity (certainty of the data, reliability of sources as well as accuracy) and other characteristics like exhaustion, extensionality, and complexity (OECD 2019[44) (IBM 2020[1111). Veracity is a crucial aspect because it can be challenging for the user to judge whether the data used is reliable and complete. reliable, and could need to be evaluated on a case-by-case basis. Chief Investment Officers Email List

Big data could comprise climate information satellite photos, images or videos, as well as transition record, GPS signals, as well as personal datalike names, images or email address, bank information as well as posts on social network websites, medical information or even a computer’s IP address (OECD 2019, 2019[44). The data can challenge the conventional methods due to its magnitude complexity, size, or frequency of availability. It requires sophisticated digital techniques, including ML models to analyze these data. A growing usage of AI in IoT applications is also creating large amounts of data which feed directly into AI applications.

The availability of data lets ML models to be more effective because they are able to learn from examples used to train the models in an iterative process known as teaching the model (US Treasury, 2018, [88).

_purchase CIO email lists

1.2.1. A rapidly-growing field in business and research

Increased use of AI applications can be seen in the increased spending of AI from the commercial sector, along with a growing research effort regarding this technology. The world’s spending on AI is predicted to double in the four years ahead, increasing to $50.1 billion during 2020 and more than $110 billion by 2024 (OECD 2019, 2019[44). According to IDC estimates, investment in AI technology will grow in the coming years with an anticipated CAGR of c.20 percent from 2019 to 24 as businesses implement AI in their digital transformation initiatives as well as to stay competitive in the modern economy. Private equity investments in AI companies has increased by more than a third in 2017 on year-to-year basis , and attracted 12 percent of the world’s private equity investment in H1 2018 (OECD 2019[55). In the same way the rate of growth in AI-related research is much higher than the growth in research in general or computer science papers, which further demonstrates of growing interest in this cutting-edge technological advancement (Figure 2.1).

CIO mailing lists

1.2.2. AI in supervision and regulatory technology (‘Regtech” and “Suptech”)

Financial market regulators are increasingly looking at potential benefits from the application of AI insights in tools that are referred to as “Suptech,” i.e. applications that use FinTech to assist authorities for supervisory, regulatory and oversight functions (FSB 2020[12[12]). Additionally, regulated institutions are creating and implementing FinTech applications to meet compliance and regulatory requirements as well as the reporting (‘RegTech’). Financial institutions are using AI software for internal control as well as risk management as the integration of AI technology and behavioural technologies will allow large financial institutions to stop misconduct and shift the focus away from post-mortem resolution to proactive prevention (Scott 2020[13[13, 2020]). buy CIO email database

The increase of RegTech as well as SupTech applications is mostly due to supply side drivers (increased access to information, including machine-readable ones and the development of AI methods) and demand-side drivers (potential to improve efficacy and efficiency of regulation processes as well as potential to gain greater insight into compliance and risk developments) (FSB 2020[1212).

Despite the potential and benefits of implementing AI to supervise and regulate purposes, authorities must be vigilant due to the risks that come with the application of these technologies (resourcing cybersecurity risk, risk to reputation data quality concerns, and limited transparability and interpretation) (FSB 2020[1212). These are the risk factors present in the implementation of AI by participants in the financial markets and are covered more in depth within the report.

_purchase CIO email lists

The use of AI in finance is fueled by the growing and large amount of data available in financial services, and the expected competitive edge that AI/ML will offer to firms in the financial sector. The explosion of data available as well as analytical data (big data) along with lower-cost computing capabilities (e.g. cloud computing) can be analysed using algorithms to discern patterns and underlying relationships within data in a way that is beyond the capabilities of human beings. The adoption of AI/ML as well as big data by companies in the financial sector is predicted to drive the competitive advantages of firms by enhancing the companies efficiency, reducing their costsand increasing the quality of financial service products that customers demand (US Treasury 2020).

This article examines the possible impact that application for AI or big data could impact certain financial market transactions such as asset management, trading, investing and banking; and blockchain application in the field of finance.

2.1. The allocation of portfolios in asset management6 and the wider investing community (buy-side)

The application of AI and ML in asset management could be able to boost the effectiveness and precision in operational workflows. It can increase the performance of risk management, increase efficiency and enhance customer experience (Blackrock 2019[14[14]) (Deloitte 2019, 2019[1515). Natural Language Generation (NLG) is a subset of AI is a tool that can be utilized by financial advisors in order to “humanize the analysis of data and to make it simpler for and report to clients (Gould 2016[1616). Since ML models are able to monitor the risk of thousands of factors a regular basis and assess the performance of portfolios in a myriad of economic and market scenarios and scenarios, this technology will enhance the risk management process for asset managers as well as other institutional investors with large amounts of capital. Regarding operational benefits, the application of AI will reduce the back-office expenses that investment management firms incur, and replace the manual process of reconciliation by automated reconciliations which could cut the cost of reconciliation and improve speed. buy CIO email database

CIO lists

Incorporating ML models with large data may give asset managers recommendations that impact the decisions made regarding the allocation of stocks to portfolios or portfolios according to the type of AI method used. Data from big data have replaced conventional data sets that are now considered an item that is readily available to investors of all kinds, and is used by managers of asset portfolios to obtain insight regarding their investment strategy.

_buy CIO targeted email list

For investors data is always a key element and data has been the core of numerous investment strategies, ranging starting with fundamental research to quantitative and systematic trading strategies in all. While structured data was at the core of such ‘traditional’ strategies, vast amounts of raw or unstructured/semi-structured data are now promising to provide a new informational edge to investors deploying AI in the implementation of their strategies. AI helps asset managers absorb massive quantities of data from multiple sources and draw insights from their data to help them formulate their strategies within very brief intervals.

The use of AI/ML as well as big data could be restricted to asset managers with larger portfolios or institutional investors with the resources and capacity to make investments in AI technologies, potentially creating obstacles to the use of these techniques for smaller actors. A significant investment in technology and expertise is needed to explore and transform vast quantities of unstructured, new datasets of large data, and create models using ML. In the event that use of AI and proprietary models gives the advantage in performance over rivals which could, in consequence, restrict participation by smaller companies that can’t adopt AI/ML in-house or utilize big data sources. This could further exacerbate the current trend of concentrated effort in a handful of bigger players that are evident in the industry of hedge funds, because larger groups are able to outperform the smaller competitors (Financial Times 2020[18and 2020[18]). CIO lists

The limited participation of smaller players will continue until the field is at a stage where these tools are made available as services through third-party vendors. However the third party data may not be held to the same level across all industries. those who use third-party tools will need to establish trust in the reliability and accuracy of the data used (‘veracity of large data) in order to achieve an amount of confidence for them to use them.7

The use of similar AI model by a vast number of asset managers may cause herding behaviours and market one-way, which could create risks for liquidity and reliability of the financial system, particularly during times of pressure. Market volatility may increase due to massive purchases or sales that are made at the same time, leading to new vulnerability sources (see section 2.2).

One could argue that the application of AI/ML as well as big data in investing could alter the trend toward passive investing. If the application of these new technologies is proven to generate alpha consistently, which suggests a cause-and-effect relationship between the application of AI and the performance that it provides (Blackrock 2019, [14]) (Deloitte 2019[1515]) The active investors could profit from this opportunity to reenergize active investing and offer the opportunity to increase their alpha for their clients.

_buy CIO database for marketing

2.1.1. The performance of hedge funds powered by AI and ETFs

Hedge funds are on the forefront of FinTech users and employ massive data AI and machine learning algorithms in the execution of trades and back office processes (Kaal 2019[19[19). A new class of AI pure-play’ hedge funds have been emerging in recent years that are built entirely upon AI as well as ML (e.g. Aidiyia Holdings, Cerebellum Capital, Taaffeite Capital Management and Numerai) (BNY Mellon, 2019[20]).

As of now, there is no research or independent analysis of the effectiveness of AI-powered funds by an independent source, or looking at the different funds that claim to be powered by AI. Fund managers employ different levels of AI in their business and strategies and are not willing to divulge their strategies in order to preserve their competitive edge. While some funds might be advertising their products as AI driven’ however the degree of AI utilized by funds and the level of sophistication of the deployment of AI differ significantly, creating a challenge to assess performance of the various companies that claim to have AI products.

Indices from the private sector of hedge funds powered by AI show the superiority of AI-powered funds over traditional hedge fund indices offered through the same sources (Figure 2.2). Indices offered by third-party sources are susceptible to a variety of biases, including self-selection bias and survivorship of the constituents of the index or back filling. They should be handled with care. email marketing database CIO

CIO Email

Note that the Eurekahedge Hedge Fund Index is Eurekahedge’s most popular index that is equally weighted of 2195 fund constituents. The index was created to be a comprehensive measurement of the performance of the hedge fund managers that are in charge regardless of their regional mandate. The index is based on a base weighting at 100 as of December 1999, and does not include duplicate funds and is calculated in local currency. It is the Eurekahedge AI Hedge Fund Index is an index with equal weighting comprised of 18 funds. The index was designed to be a broad gauge of the performance the hedge fund managers that employ AI and ML theories to manage their trading. The index is based on a base weighting at 100 as of December 2010 It does not include duplicate funds and is based in USD. This index Credit Suisse Hedge Fund Index is an hedge fund index that is weighted by assets that includes closed and open funds.

Source: Eurekahedge; Datastream, Thompson Reuters Eikon.

ETFs that are powered by AI and where investments are made and performed by models aren’t at a significant dimension as of. The AuM total of this group of ETFs has been calculated to be c. 100 million USD at the close of the year (CFA, n.d.[21]). The efficiency gained by the implementation by AI for automated ETFs reduces management costs (estimated to be an average annual fee of 0.77 percent as of the end of the year). Regarding forecasting accuracy it is becoming clear that ML models beat traditional forecasts for macroeconomic indicators like GDP and inflation (Kalamara and others. 2020[22[22.). These improvements are evident most during times of economic stress , when probabilities suggest, forecasts are most crucial. There is also evidence to support the advantages of AI-driven methods in identifying relevant yet previously undiscovered correlations in the financial crisis pattern and ML models generally surpassing logistic regression in forecasting and out-of-sample prediction (Bluwstein and colleagues. 2020[2323). CIO mailing lists

_CIO database for sale

2.2. Algorithmic Trading

AI can be utilized in trading to offer strategies for trading and also to generate automatized trading platforms that can make predictions, determine the path to take and then make trades. AI-based trading systems that operate on the market are able to identify and complete trades completely independently, without any intervention from humans, making use of AI techniques like deep learning, evolutionary computation as well as probabilistic logic (Metz 2016[24[24.]). AI-based techniques (such such as the algo wheel) help to plan the future trade in a structured manner, by allowing an “if/then” method of thinking to be used as an aspect of the procedure (Bloomberg 2019[2525.) (see the box 2.1). With the increasing interconnectedness of different asset classes and geographical areas and geographies, the use of AI can provide predictive capabilities which is quickly surpassing the capabilities of conventional algorithmic trading and finance.

AI-enabled trading systems are also able to assist traders in their risk management as well as in the administration of how they move their order. For instance, AI-based systems can monitor the risk exposure and modify or close the position based on the preferences of the client completely automated and without the requirement for programming reprogramming. They learn by themselves and can adapt to market conditions without (or with minimum) the intervention of a human. They could help traders control their transactions with their brokers, in the case of trades that have been decided on, and manage fees and allocate liquidity to various pockets (e.g. regional market preferences, currency decisions or other aspects of process of order management) (Bloomberg 2019, 2019[25[25.]).

In highly digitalized markets like the ones for FX and equities, AI solutions promise to offer competitive pricing, manage liquidity, and improve execution. In addition, AI algorithms deployed in trading can improve the management of liquidity and execute large orders with minimal impact on markets, through optimizing length, size, and order size in a dynamic manner depending upon market trends.

The application of AI and big data for sentiment analysis to detect trends, themes or trading patterns is expanding the practice, which is not new. Traders have mined news reports and management announcements/commentaries for decades now, seeking to understand the stock price impact of non-financial information. Nowadays the mining of texts and the analysis of tweets and social media posts or satellite information through the application in the use of NPL algorithms is a prime example of how new technologies that guide trading decisions since they can automate data collection and analysis as well as identify persistent patterns or patterns at a scale that human being cannot comprehend. email marketing database CIO

CIO email database

What makes AI-managed trading distinct from systemic trading is reinforcement learning process and adjustments to adapt the AI model to the changing market conditions. Traditional systematic strategies take time to modify parameters due to the extensive human involvement required. Traditional back-testing strategies built on historical data could not yield good results in real-time because trends previously observed are unable to be sustained. The application in ML-based models could shift focus of analysis towards the forecasting and the analysis of trends in real-time such as using “walk forward” tests rather than back testing.10 These tests forecast and adjust to changes in real time , which can reduce the risk of over-fitting (or the fitting of curves, refer to section 3.5.1.) when testing backtests that are based on the historical information and trends (Liew 2020[26[26, 27]).

_CIO address lists

Algo wheels are a broad concept that covers fully automated solutions that are CIO email id list mostly a trader-directed flows. A computer-based algo wheel can be described as an automatic route-finding process using AI methods to assign an algorithm for brokers to trades from a pre-configured list of algorithms (Barclays Investment Bank 2020[2727). In the simplest terms, AI-based algo wheel models determine the most efficient strategy and broker

through which to route the order, depending on market conditions and trading objectives/requirements.

The majority of investment firms use algo wheels for two main reasons; first, to gain improvements in performance through better execution quality, and secondly to increase efficiency of workflow by the automation of small order flows or converting broker algorithms into uniform names conventions. Market participants believe that using algo wheels can reduce market biases of traders regarding the choice of the broker and the algorithm that is used in the market. CIO quality email lists

The estimate is that around 20% of trades are currently going through algorithm wheels. The system is becoming more widely accepted as a method of classifying and evaluating the top performers in broker algos (Mollemans 2020[28[28.]). However, those that use it, are using it to make up 38% of the flow. The potential for widespread adoption of algo wheels may result in growth in the general quantity of electronic trading which could be beneficial to the marketplace of online brokerage (Weber 2019, 2019[2929).

The application in the use of AI for trading passed through various levels of development as well as corresponding degree of complexity. It adds a layer of traditional algorithmic trading in each stage of the process. The first generation of algorithms comprised buy or sell orders based on basic parameters, then later, algorithms allowed to dynamically price. Second-generation algorithms utilized strategies to break massive orders and minimize market impacts, which helped to get more competitive prices (so-called “execution Algos”). Strategies based upon deep neural networks have been developed to offer the most efficient ordering and execution styles that minimizes market impact (JPMorgan 2019[30[30]). Deep neural networks are modeled after the human brain using the use of algorithms developed to detect patterns, and they are not dependent on human input to operate and to learn (IBM 2020[31[31]). The application of these methods could benefit market makers by improving their control of their inventory and lower the costs of their balance sheets. As the advancement of AI is advanced, AI algorithms evolve into computer-programmed, automated algorithms that learn from input of data and are less dependent on human interaction.

_CIO email database providers

In reality, the more advanced versions of AI currently are utilized to recognize signals that come from ‘low-informational significance’ events that occur in the flow-based trading11 that consist of events that are less apparent which are more difficult to recognize and deduce value from. Instead of aiding in the speed of execution, AI can actually be utilized to discern signals from the noise of data and transforms that information into decisions about trading. The less advanced algorithms are typically used in ‘high informational occasions such as information about economic events which are evident for everyone to comprehend and for which execution speed is essential.

At the moment of their development, models based on ML are not designed to trading in front and benefit from speed of movement, like strategies for HFT. Instead, they’re limited to offline use to help with the calibrating of algorithm parameters as well as to improve algorithms’ decision making process, not for execution (BIS Markets Committee 2020[3232). In the near future, however as AI technology improves and becomes utilized in more scenarios and applications, it will enhance what is possible with traditional algorithms for trading, which will have implications for the financial market. It is anticipated that this will happen as AI techniques begin to be used in the execution stage of trades, providing greater capability for automated trading and supporting all the steps starting with the detection of signals, to formulating strategies and then the execution of them. Algorithms based on ML will enable the automatic and dynamic modification of their own algorithms when trading. In this case the rules that are already in place to algorithmic trading (e.g. security measures built into the risk management systems prior to trading and automated control mechanisms that turn off the algorithm when it exceeds the limits that are built into the risk management model) must extend to AI-driven trading.

CIO email listing

2.2.1. Unintended consequences and potential risk

The usage of similar or identical models by a wide range of traders can result in unintended effects on competitionand may result in the increase of market stress. The introduction of models that are widely used will naturally limit the arbitrage opportunities that are available, reducing margins. The end result would be a benefit for consumers as it reduces bid-ask spreads. But it could lead to convergence, herding and one-way markets, which could have potential implications to the stability of market as well as for liquidity, especially in times of extreme stress. Like any algorithm the widespread application that is similar to AI algorithms can lead to the possibility that feedback loops self-building, which could, in turn, result in sharp price swings (BIS Markets Committee 2020[32[32.]). buy CIO database online

This kind of convergence can also increase the threat of cyber-attacks since it becomes more easy for cybercriminals to influence agents that behave in the same manner than autonomous agents that have distinct behavior (ACPR 2018, [33]). Concerning cyber-security when AI is employed in a criminal manner it is able to carry out offensive attacks autonomously (without intervention from humans) on vulnerable systems within trading, but also across financial markets and other participants (Ching TM 2020[34[34]).

_buy CIO database online

The usage in the creation of models proprietary to one that are unable to be replicated is essential to ensure that traders have a competitive advantages, and could lead to the intentional deficiency of transparency, thereby contributing to the difficulty of explaining the workings of models created by ML. The inability of users of ML methods to divulge their models’ workings in the fear that they will lose their edge creates questions regarding the oversight of algorithms and ML model (see section 3.4).

The algorithmic trading may also enable collusion outcomes to be sustained as well as more likely to get seen in the digital market (OECD 2017[35[35.]) (see 4.2.1). 4.2.1). This is in addition to the chance that AI-driven systems could make it more difficult for illegal practices to influence markets, including’spoofing and’spoofing’. They can make it harder for supervisors to spot these practices when collusion between machines is occurring (see the box 3.2. The inability to explain models based on ML that are used to support trading may make the adjusting of the strategies difficult during periods of low performance in trading. The algorithms used to trade are now linear model-based processes (input A has caused trade strategy B implemented) which can be tracked and analysed, and there is a clear understanding of the factors that drove the results. When there is a lack of performance the most important thing is for traders to break down the results into the fundamental driving factors behind the trading decision in order to modify and/or correct based on the situation. But, even in the case of high performance, traders cannot comprehend why the trade was successful madeand, consequently, can’t determine whether the result can be attributed to the superiority of the model or ability to recognize the patterns in the data, or simply luck.

Concerning potential unintended consequences to the market one could argue that the use of AI technology to trade and HFT can increase volatility in markets due to large transactions or sales that are executed at the same time, leading to new vulnerability sources (Financial Stability Board 2017[36[36]). Particularly, some of the algorithms for HFT appear to have been responsible for high market volatility as well as decreased liquidity, and more severe flash crashes which have been occurring with increasing frequency over the last few years (OECD 2019[37[37]). Since HFT are the main source of liquidity supply under regular market conditions and thereby improving the efficiency of markets, any interruption in the functioning of their models during situations of crisis can result in liquidity being withdrawn from the market, and could have an negative consequences for the resilience of markets. CIO quality email lists

Box 2.2. “Spoofing” means using algorithms in manipulating markets

Spoofing is a shady market manipulation technique that involves placing offers to purchase or sell commodities or securities in the hope of reversing the offers or bids prior to the transaction’s execution. It’s designed for creating a false impression of the demand of investors in the market, thus altering the behaviour and behavior of market participants, as well as allowing the person who spoofed gain from these changes through a reaction to market changes.

_CIO email id list

Spoofing has been a common practice in the trading world prior to the advent of algorithmic trading, however it has become more prevalent with the advent of high-frequency trading. Spoofing strategies for manipulating markets was identified as one the major triggers behind the Flash Crash of 2010. Flash Crash (US Department of Justice 2015[3838]).

CIO email leads

In the event of a hypothetical scenario the deep learning ML models that learn from the behavior of other models and adjust to changing circumstances may begin to collaborate together with different ML models to benefit of these practices. In these scenarios an entity that trades that uses ML models could be involved in spoofing, and instead of benefitting it, might pass the benefit on to a different model within the firm , or even to an other trading company using similar models, making it difficult for supervisors to detect and demonstrate the intention. This is possible because ML models can co-ordinate the behaviour of two people without communicating explicitly, and self-learning as well as reinforcement learning models can learn and adapt their behavior dynamically according to changes in the behaviour of others.

Similar to the issues mentioned when investing, huge use of off-the-shelf AI model by the participants of markets could result in the potential to impact liquidity and stability of markets, due to the possibility of herding or market movements that are one-way. This could also increase the risk of volatility, procyclicality and sudden changes in markets, both in terms of size as well as in regards to direction. Herding behavior could result in markets becoming illiquid due to the absence of shock absorbers or market makers who are capable of taking on the other aspect of transactions.

The application in the use of AI in trading could improve the interconnectivity of financial institutions and markets in unexpected ways and could increase the relationships and dependencies between previously not related elements (Financial Stability Board 2017[36[36.]). The increasing application of algorithms that produce uncorrelated returns or profits could create correlations in independent variables when their use can be sufficiently large. They can also enhance network effects, like sudden changes in the size or direction in which the market movements. purchase CIO email lists

_buy CIO email database

To reduce the risk from the use in the use of AI to trade, security measures might need to be in place to protect against AI-driven algorithmic trading. Security measures built into the these risk management systems for pre-trading are intended to stop and prevent misuse of these systems. Incredibly, AI has also been utilized to create better pre-trade risk control systems, which include, among other things the requirement to test every version of an algorithm, and would apply for AI-based systems. Automated control mechanisms that immediately turn off the algorithm are the most effective line of defense for market professionals in cases where the algorithm has gone far beyond risk systems and involve pulling off the switch’ to replace the technological system with human handling.12 These mechanisms can be considered to be suboptimal from a policy standpoint since they turn off the functioning of systems when they are needed during situations of stress and create operational weaknesses. Chief Investment Officers Email List

Security measures may also have to be implemented on the part of exchanges in which trading takes place. This could include automated cancellation of orders if they are cancelled by the AI system is shut off due to a reason, and techniques that offer protection against sophisticated manipulation techniques made possible by technology. Circuit breakers, as they are now triggered by large drops in the trade might be able to detect and trigger by large quantities of smaller transactions performed by AI-driven platforms, which would have the same effect.